China’s annual online shopping festival, Singles’ Day (also known as Double 11 or 11.11), kicked off in late October and is expected to generate the usual mind-boggling figures as it enters its 15th year, writes Robynne Tindall

Although in recent years, some have started to question the relevance of Singles’ Day (especially after Alibaba declined to release sales figures for the first time in 2022, it remains a major event on the sales calendar that brands ignore at their peril.

Below, we review some of the major consumption trends that we are seeing in the run-up to Singles’ Day 2023.

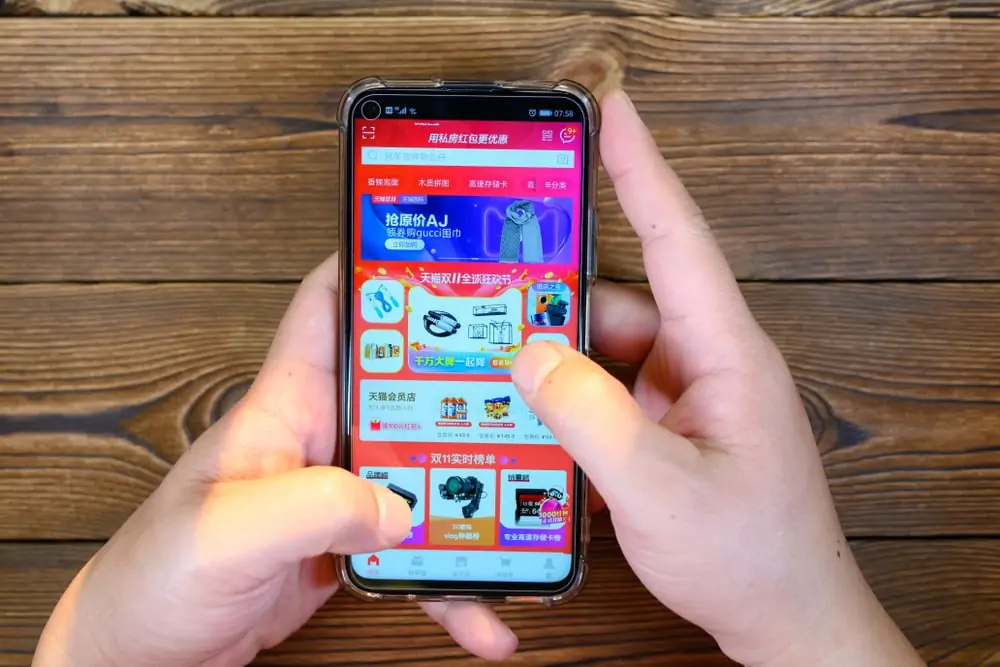

Sales are increasingly spread across multiple platforms

As CBBC’s Celine Tang, China Business Adviser (Consumer Retail & E-Commerce), noted in our analysis of Singles’ Day last year, “An increasing number of consumers are planning to purchase products on at least three different platforms (or even more than five). This is due to different discounts being offered and consumers being more loyal to brands rather than to platforms.” This is truer than ever with the rise of social commerce platforms like Pinduoduo and Douyin; the latter’s beauty division recently achieved its highest-ever sales, exceeding RMB 113 billion (£12.6 billion) in just the first three quarters of this year.

Low cost vs. high value

In its early years, Singles’ Day was all about low, low prices, and while the proposition has shifted somewhat in recent years, Alibaba has said it will be offering major discounts in 2023, including RMB 50 off every RMB 300 (equivalent to 17%) spent on B2C marketplace Tmall. Chinese consumers (especially middle-class consumers in tier 1 and tier 2 cities) are becoming increasingly value-sensitive, often willing to pay high prices but only if they feel they are getting a unique value proposition. For brands, this could mean creating special product bundles for Singles’ Day or even using the event to launch new or limited-edition products.

Physical products are not the only things on sale

As Chinese consumers show an increasing demand for ‘experiences’ rather than just ‘products’, a wider range of platforms are taking part in Singles’ Day promotions. For example, Alibaba Group’s online travel platform Fliggy has launched a record number of Singles’ Day travel promotions, with Marriott, Hilton, Disney and Universal Studios all taking part. Many hotels and restaurants in China will offer promotions such as voucher packs or discounted lunch or dinner buffets.

The growing role of AI

Last year, the Singles’ Day buzzword was “metaverse”, but as with so many conversations this year, the focus has shifted to AI. In 2023, Singles’ Day shoppers will get a helping hand from Taobao’s AI assistant, Wenwen, for the first time. The chatbot, which has been tested by over 5 million people since September, can give purchase suggestions (e.g., for the best-value down jacket) or help shoppers get the best prices by analysing combinations of discounts. On the brand side, platforms are using AI tools to help merchants with things including image and text content generation, data analytics, and customer service.