More than four years on from the release of a major plan for the development of the Guangdong-Hong Kong-Macao Greater Bay Area, what opportunities does one of the world’s largest economic zones offer UK businesses?

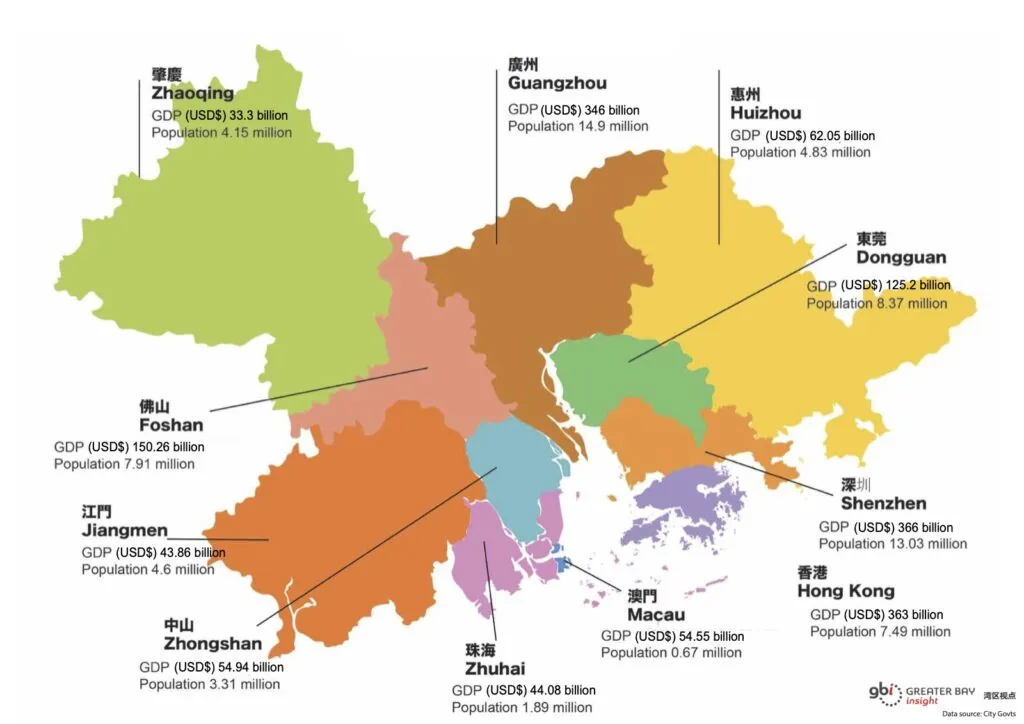

The Greater Bay Area (GBA), which covers nine municipalities of Guangdong Province (Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing) around the Pearl River Delta, plus the two Special Administrative Zones (SAR) of Hong Kong and Macau, has long been a trading hub that connects China to the rest of the world.

For centuries, the trading posts at Lumen and Guangzhou welcomed traders from Europe, the Middle East, Africa, India and South East Asia. Even during the relatively isolationist Mao era, the Canton Fair (now known as the China Import and Export Fair) continued to host foreign merchants twice a year. In 1953, the famous Icebreaker Mission, led by the British economist Joan Robinson, travelled to Guangzhou to sign a business arrangement which ended the boycott imposed by the UN in response to the Korean War.

The Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, published on 18 February 2019, set out a bold vision for a region that has long been one of China’s most dynamic and highest in potential. The plan proposed a far-reaching overhaul of the Pearl River Delta’s infrastructure and administrative set-up to expand on existing strengths and pave the way for further economic expansion.

The major cities of the Greater Bay Area

The region has developed rapidly since the release of the plan, despite the impacts of the Covid-19 pandemic, largely thanks to five main geographical and structural advantages:

- The GBA hosts three of the world’s 10 busiest container ports — Shenzhen, Guangzhou and Hong Kong (according to the World Shipping Council) — and has direct access to the South China Sea, which carries an estimated one-third of all global shipping.

- Together with a sprawling network of waterways, the region has over 11,200km of express roads and a railway network the size of a small country, providing convenient and easy access to China’s vast consumer market.

- The GBA is a key manufacturing hub, accounting for 35% of exports from mainland China, Hong Kong and Macau. Advanced manufacturing, in particular, is becoming a key area of investment, with the region seeing major growth in new energy industries such as lithium batteries and photovoltaics.

- The region hosts some of the most innovative and technologically advanced companies on earth. In 2017, nearly 14% of all Chinese patents were filed by companies based in the GBA. Shenzhen alone accounted for over 40% of international patent applications from China.

- Businesses in the delta can access three of the world’s leading financial centres. Aside from Hong Kong, which occupies fourth place on the Global Financial Centre Index, Shenzhen and Guangzhou, which come in at 9th and 25th respectively, represent two new emerging finance hubs.

The British business community is watching the development of the Greater Bay Area with great interest. For UK companies consider it to be an important driver for their Greater China operations, whether in financial services, technology and innovation, or other sectors.

Sir Sherard Cowper-Coles, Chair, China-Britain Business Council (CBBC)

Key areas of opportunity in the Greater Bay Area

Infrastructure

There are few regions as well-networked as the GBA. Large-scale infrastructure projects, including the Hong Kong-Zhuhai-Macau Bridge, completed in 2018, and the express rail network that links Hong Kong to Shenzhen and Guangzhou and onwards to China’s vast high-speed rail network, have made it quick and easy to travel around the region, achieving a level of convenience that will only expand now the restrictions of the Covid-19 pandemic have been lifted. Green infrastructure – including low carbon transportation, green buildings, water and waste management, and more – is also a major part of the region’s current infrastructure boom, with green infrastructure investment accounting for RMB1.9 trillion of the total RMB 5 trillion earmarked for major infrastructure projects in Guangdong Province’s 14th Five-Year-Plan (FYP).

Advanced and high-tech manufacturing

According to the Department of Industry and Information Technology of Guangdong Province, in the first six months of 2022, advanced manufacturing and high-tech manufacturing accounted for 55.9% and 33.1%, respectively, of the industrial added value of the GBA. Key industries include electronic communication devices, automobiles, and chemical products. The growth of this sector in the GBA has been and will continue to be made possible by the provision of research funds, the construction of facilities such as high-tech industrial parks and national supercomputer centres, and the recruitment of human resources from around the world (for example, the Shenzhen Government has offered subsidies for undergraduates who move to Shenzhen). The establishment of cross-border “cooperation zones”, such as the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone, has also played a key role.

In Hong Kong itself, the government has made unprecedented strides to promote information and technology development by investing more than HK$130 billion from 2017 to 2021. StartmeupHK, an initiative by InvestHK, also supports startup ecosystem stakeholder companies to set up a presence in Hong Kong, and provides a one-stop service platform to enable them to grow from Hong Kong into the wider GBA.

Financial Services

A growing economy and an increasingly affluent population have made the GBA an attractive market for financial services products. Hong Kong is already an international finance centre, with financial services accounting for 23.3% of the SAR’s GBP in 2020, and the GBA has enabled much greater connectivity between Hong Kong and mainland China’s capital markets. On 10 September 2021, the Cross-boundary Wealth Management Connect was officially launched to enable residents in Hong Kong, Macao and nine cities in Guangdong Province to carry out cross-border investment in wealth management products distributed by banks in the area. According to a January 2023 report published by Bain, SMEs in the GBA also present a substantial opportunity for financial services providers, requiring support for expansion “including more convenient lending, professional wealth management services, flexible insurance policies, and comprehensive cash and liquidity management.”

Register now for the UK-GBA Conference in Shenzhen on Tuesday, 21 November

CBBC’s UK-GBA Conference, coinciding with the visit of CBBC’s Chair, Sir Sherard Cowper-Coles, and Chief Executive, Andrew Seaton, will provide a platform for senior-level representatives from our Members, partners, and other key stakeholders to discuss the latest developments and strategies for British companies in the GBA region. Also joining us will also be representatives from the British Government, Shenzhen and other GBA local Governments, as well as representatives from British and Chinese companies in Guangdong, Hongkong, Macau, and from other parts of China.