In this six-part business guide to doing business in China produced by Hawksford, we’ll give an overview of what you need to consider before entering the market. Ranging from localisation, to the legal and banking systems, to type of company set up. This series is a great jumping-off point to understand the many nuances of doing business with China.

Part 5: Sector-specific opportunities

There are opportunities for doing business in a wide range of industries in China. In this section, CBBC profiles a selection of those offering the most potential, alongside specific recent developments of particular interest to international companies.

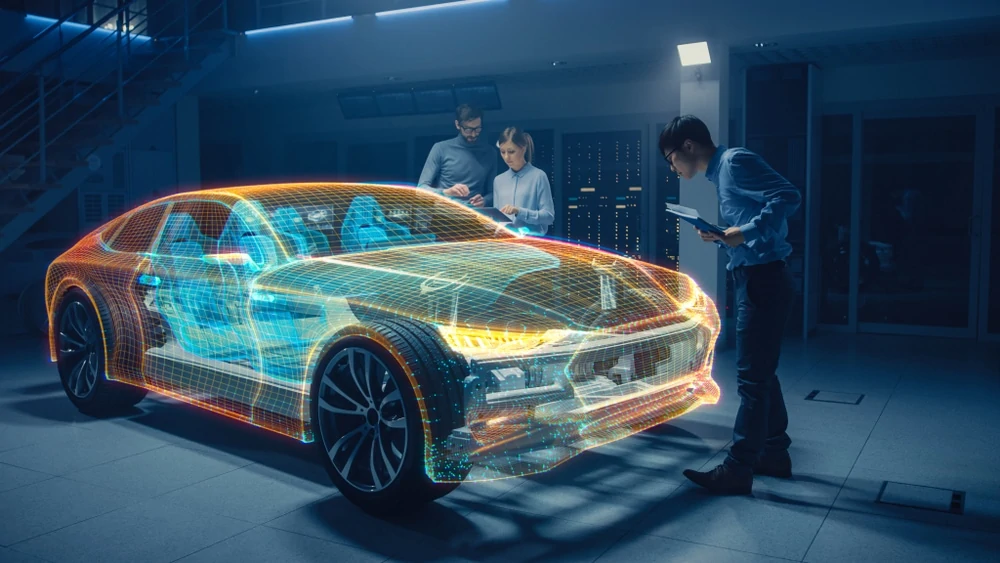

Automobiles, automotive parts and autonomous driving

International brands now make up 61% of vehicles sold in China, with the country accounting for over a third of Audi, Volkswagen and General Motors’ global sales. Accompanying this is a pivot towards new energy vehicles (NEVs) within the Chinese automotive market: 1.2 million NEVs were sold in 2019 and the goal is for them to make up 25% of Chinese automobile sales by 2025. Aside from automobiles themselves, sales of automotive parts in China were worth RMB 4.6 trillion in 2018, while autonomous driving technology offers collaboration opportunities to foreign technology firms and more traditional automotive companies alike.

Transportation

In 2019, 45% of new ship orders worldwide came from China, and looking ahead, the country will move further into the LNG/LPG carrier, special engineering vessel, passenger ship, and luxury cruise ship industries, while also focusing on new technology such as intelligent ships and those that provide greater energy efficiency. At the same time, within the aircraft industry, the number of airports in China is predicted to approximately double by 2035. In both of these industries, opportunities exist throughout the supply chain, as well as in providing training and related services.

Healthcare provision

At 5.7%, China spends a smaller proportion of its GDP on healthcare than many of the world’s other major economies (9.6% in the UK, 10.9% in Japan, and 7.6% in South Korea), meaning there is room for growth going forward. There are opportunities for international companies in providing medical devices, elderly care, training, and contract research organisation services.

Semiconductors, chips and sensors

China purchased an estimated 60.5% of the world’s semiconductors in 2019 – a level of demand driven by a focus on 5G, the Internet of Things, AI, and autonomous vehicles and NEVs – up from 42.8% a decade earlier. There remains, however, a large gap between Chinese demand and its actual output, as well as a quality gap between China’s semiconductor companies and their European and US counterparts – gaps that will continue to be filled by international manufacturers for some time to come as China increases its output and catches up with leading international standards.

Fintech

With a focus on banking, investment, asset management, insurance and internet finance, China’s fintech sector benefits from fewer regulations than those in other countries, making it an attractive destination for companies involved in big data, AI, and cloud computing.

AI

An ageing society and low levels of productivity mean becoming a world leader in AI is a key component of China’s goal of transitioning to an economic model led by consumption and advanced technology. China already has the world’s second-largest AI industry, being an industry that is supported by government backing and access to a large set of population data.

An ageing society and low levels of productivity mean becoming a world leader in AI is a key component of China’s goal of transitioning to an economic model led by consumption and advanced technology.

Software as a service

Although an estimated 10% of global SaaS demand comes from China, the adaptation rates of SaaS remains low in key areas such as office automation, cloud storage, HR services, business analytics, finance, healthcare, and industrial application. Furthermore, Chinese suppliers can lack the experience of their foreign competitors, leading to a preference for international SaaS services. There are therefore significant opportunities in China for international providers, with more traditional secondary sector industries such as manufacturing now displaying a growing interest in such services alongside the tertiary sector.

Education and training

China is the world’s largest market for pre-school education, is home to over 1,100 international schools (expatriate schools, private bilingual schools and international departments of Chinese state schools) and has over 2,600 public universities and colleges. Many of these institutions offer international education providers opportunities through content contribution, exchanges and investment and collaboration, while new opportunities are also appearing in the digital education sector.

Creative industries and sports

International creative content remains popular in China and, following the development of the country’s 5G network, live streaming, mobile games, digital publishing, mini-series and short films are all emerging as markets offering particularly high growth rates that international content producers can take advantage of. Alongside more established sports, China is now the world’s largest video game and e-sports market, offering further markets for foreign companies’ products and services.

Consumer goods

Internationally branded consumer goods continue to be popular across China, with sportswear, children’s wear, skincare products, accessories and homeware all experiencing high demand, reflecting a trend in China of moving towards healthier and higher-quality lifestyles. Any international brand selling to China benefits from having a deeper understanding of the importance of the country’s e-commerce environment – the world’s largest and one that generated sales of US$4.98 trillion in 2019 – and how the integration of mobile payment with platforms offering social media and live streaming functions is driving both demand and fashion.

Food services

Smaller food service companies such as local restaurants are leading in the Chinese market, yet long-term trends such as increasing urbanisation and a desire for healthier food are increasingly favouring larger and often more international chains that have the resources needed to take advantage of them, including through economies of scale, bigger advertising budgets, and the ability to develop their own apps to better understand their consumer base.

PART 6: Company set up

To learn more about accessing the China market contact wilson.barrie@cbbc.org for more information