What subsidies, tax benefits and intellectual property protections can UK companies receive when setting up or expanding their presence in South China? Hawksford and Zhong Lun Law Firm explain

Cities in the Greater Bay Area (GBA), which links nine cities in Guangdong with Hong Kong and Macau, already present foreign businesses with subsidies based on the size of their investment and future contribution to the local economy with specific requirements and reward schemes varying on a municipality and sector basis.

Shenzhen is an excellent example of how the GBA plans to facilitate a business friendly-bureaucratic framework, encouraging multinational companies to establish regional headquarters in its sophisticated environment. If companies meet requirements regulating their local and overseas entities’ registered capital and management structure, the approved headquarters are entitled to a reward ranging from RMB 3-6 million (£346,000-692,000).

Over the last few years, Shenzhen has also laid out a series of provisions to simplify the overall company incorporation process, which includes shortening the time of business license issuance to a few working days and introducing company secretary virtual addresses and dormant company status.

Investors aside, today Shenzhen is also one of the most attractive cities for local and international talents in the new technologies and logistics sectors. The Notice by the Ministry of Finance and the State Taxation Administration of the Preferential Individual Income Tax Policies for Guangdong-Hong Kong-Macao Greater Bay Area (No. 31 [2019] of the Ministry of Finance) has implemented an individual income tax (IIT) subsidy scheme aimed at foreign talents employed in the nine core cities of the GBA.

The policy aims to limit the total IIT burden for the fiscal year to 15% of the yearly taxable income, and provide a refund for the exceeding part when meeting a number of specific requirements set by each municipality taking part in the initiative from 1 January 2019 to 31 December 2023.

What corporate income tax benefits does the GBA offer?

Introduced nationwide via Announcement No. 24 [2017] of the State Administration of Taxation), a reduced corporate income tax (CIT) rate of 15% against the standard rate of 25% is granted to high-tech enterprises that are eligible for accreditation based on requirements that vary on a municipal level, based on:

- Establishment and business scope of the entity (i.e., encouraged industries of investment)

- IP protection and ownership

- Research and development-to-revenue ratio

- Personnel specialisation-to-total-organic ratio

- Innovation (graded system)

- Environmental protection

This regulation finds its best application in the GBA, where tech giants like Huawei, Tencent and Foxconn are based.

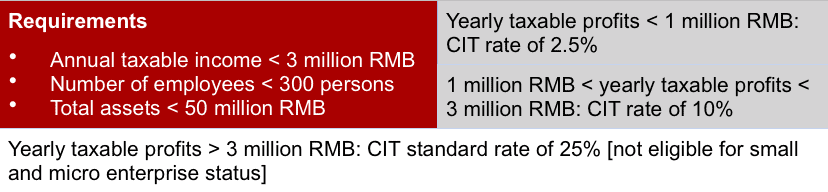

Startups and small or medium enterprises that might not fall into the above sectors or investment size can still benefit from the beneficial CIT rate granted by Article 2 of The Ministry of Finance and the State Administration of Taxation on the implementation of the inclusive tax relief policy for small and micro enterprises (Caishui [2021] No. 12). This halves the progressive enterprise income tax rate previously set by (Caishui [2019] No. 12) from January 1st 2021 to December 31st 2022.

Table 1: CIT tax rates for small and micro enterprises

The above tax treatment, implemented nationwide, would grant investors access to the GBA infrastructure and environment even when the investment volume and operations are limited during the startup period.

Understanding intellectual property rights in China

In 2020, China revised four IP-related laws and regulations (namely the Patent Law, Copyright Law, Criminal Law and the provision on the transfer of suspected criminal cases by administrative law enforcement organs); issued six judicial interpretations (covering commercial secrets infringement, application of laws in infringement disputes, and IP-related criminal cases); implemented more than twenty policies, and set two national standards for IP protection (related to IPR on e-commerce platforms and recommended national standards for patent guidance).

Through these continued efforts, China now ranks 14th among 131 economies according to the World Intellectual Property Organisation’s Global Innovation Index 2020. While ranking highly in patent registrations and total exports of creative products, China still needs to structure further reforms in areas like human capital, infrastructure, and institutional construction.

Navigating the protection of intellectual property in the Greater Bay Area

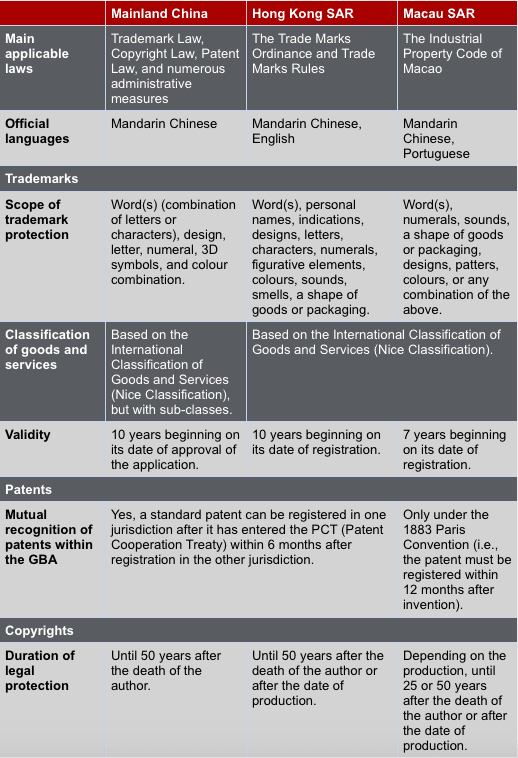

Among the challenges and opportunities of the GBA for foreign investors, the biggest might be navigating multiple municipal and regional jurisdictions. It is quite common for foreign investors to set up a Hong Kong holding company (under Hong Kong laws) for foreign exchange and tax purposes, and a PRC Wholly Foreign-Owned Enterprise (under PRC laws) 100% owned by the Hong Kong holding company for handling operations and the employment of local staff. While setting up entities in different jurisdictions can be a good strategy at the corporate level, it can create challenges for IP protection.

Beyond contractual or corporate matters, IPR territoriality is decisive. Apart from rare exceptions (such as so-called “well-known marks”), the registration of trademarks, patents or copyrights in one jurisdiction grants little to no other rights in other jurisdictions. Therefore, a rights owner’s IP protection strategy across the GBA must be assessed case by case according to the rights owner’s interests and anticipated use.

The table below outlines the main differences among the three jurisdictions within the GBA.

Table 2: Differences between the three jurisdictions

The GBA represents a privileged business destination for domestic and foreign companies operating in finance, logistics, innovation and technology, and capital-intensive industries. However, the differences in regulations among the three jurisdictions from legal, accounting and tax perspectives add a level of complexity.

In light of this, companies should carefully plan an entry strategy in the GBA, evaluating all the necessary resources and steps, including how to leverage synergies and incentives in the area, how to comply with the local tax requirements, and how to hire the right and qualified personnel, all the while protecting competitive advantage and key IPR. Working with a trusted partner with local expertise will help you better navigate China’s booming market.