Danae Kyriakopoulou assesses China’s shifting role as a Global Public Investor

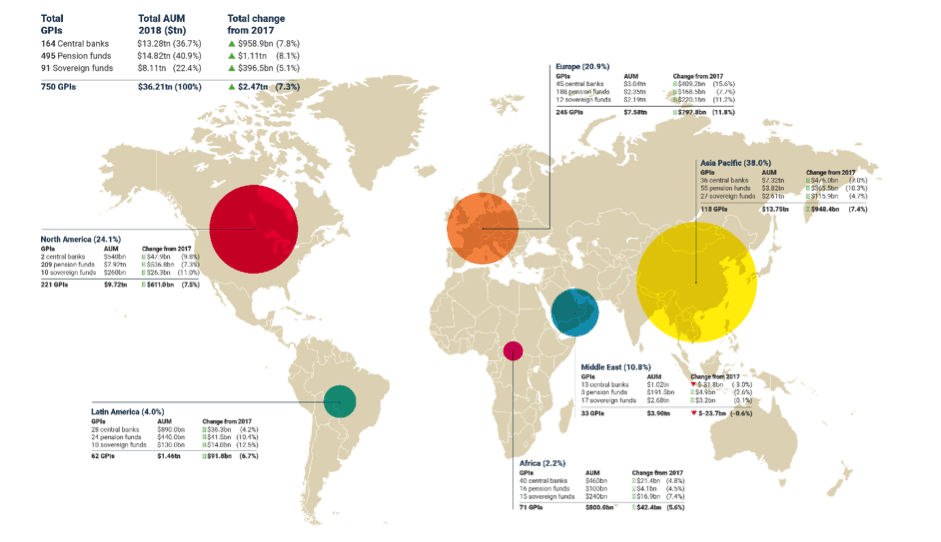

Chinese public investors – central banks, sovereign funds and public pension funds – increased their assets by $145bn during 2017, according to the Official Monetary and Financial Institutions Forum’s (OMFIF) Global Public Investor (GPI) 2018 report. The report tracks the assets under management of 750 such institutions from 174 countries that collectively hold $36.2 trillion of assets, equivalent to 45 percent of global GDP.

China, while home to only three GPIs, hosts 12 percent of total global assets. Most are held by the People’s Bank of China (PBOC). With $3.2 trillion of reserves, it is the world’s largest GPI. China Investment Corporation (CIC) ranks 6th in the global ranking, with $813 billion of assets, while the National Council for Social Security Fund ranks 28th, with $299 billion. The PBoC played a key role, increasing its reserves by $134 billion and reversing the declining trend between 2014-16. As well as a weaker dollar, this appears to reflect the Chinese authorities’ efforts to curb capital outflows through tighter regulations on outbound investment by businesses and wealthy individuals. The increase was supported by China’s strong economic performance during 2017, with GDP growth reaching 6.9 percent and exceeding the leadership’s target. This, in combination with downward pressures on the dollar, helped restore confidence in the renminbi, which appreciated by around 10 percent against the US currency in 2017.

The renminbi was the most popular currency for GPIs looking to adjust their currency portfolio allocation. Around a fifth of investors surveyed by OMFIF said they plan to increase their allocation over the next 12-24 months, the highest response for all currencies. The renminbi’s popularity is growing from a low base – central banks, the largest holders of renminbi, hold the equivalent of just $123 billion, less than Australian or Canadian dollars. However, the pace of demand growth has been impressive, matching the renminbi’s growing role as a global trade and investment currency. This is reflected in the launch of the first renminbi-denominated oil futures contract in March 2018, the inclusion of Chinese A-shares in MSCI’s indices from June 2018, and the growing number of renminbi-funded infrastructure projects forming part of Beijing’s Belt and Road initiative. China’s qualified and renminbi-qualified foreign institutional investors programmes have further bolstered foreign interest in the renminbi.

“The renminbi was the most popular currency for GPIs looking to adjust their currency portfolio allocation”

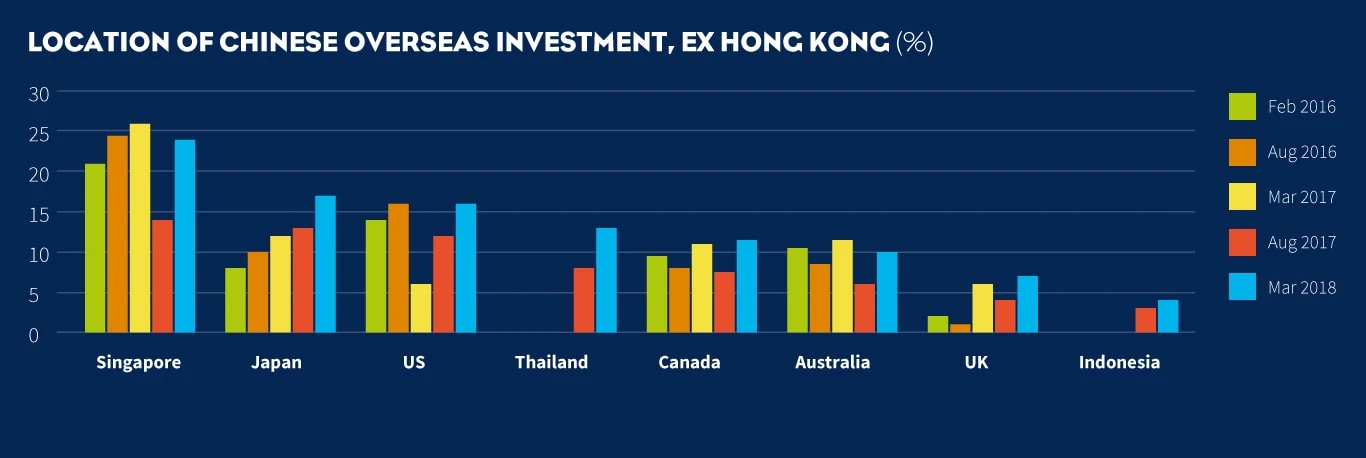

China’s GPIs and state-owned enterprises have continued to diversify their foreign holdings, shifting assets away from debt securities and into equities. These foreign direct investment assets have grown steadily in the past years to now stand at a record $1.5 trillion. These assets act as important vehicles for deploying Chinese reserves. Infrastructure has been the most popular recipient sector, attracting $455 billion of investment between 2005-17, almost half of the total $1 trillion invested over that period. The US and the European Union, particularly Britain, have been among the top destinations for Chinese foreign investment from the CIC and other state-owned enterprises.

There are challenges ahead for Chinese Foreign Direct Investment, with recipient economies considering tightening their screening rules for Chinese investment into strategic infrastructure and technology assets. Last year Jean-Claude Juncker, the president of the European Commission, indicated the commission intended to launch a framework in 2018 to screen foreign investment into assets considered important for public order and security. On 29 May this year, the White House issued a statement announcing its intention to “implement specific investment restrictions and enhanced export controls for Chinese persons and entities related to the acquisition of industrially significant technology.” This is taking place in the context of a broader reassessment of economic and political relationships between Beijing, Washington and Brussels, making the outlook for Chinese investment fragile.

Danae Kyriakopoulou is Chief Economist and Head of Research at OMFIF. For more information download a free copy of Global Public Investor 2018.

For further information on China’s Financial sector please contact avi.nagel@cbbc.org