Can cross-border e-commerce co-exist harmoniously alongside traditional distribution channels in China? Don Zhao, co-founder of Azoya, asks what are the benefits and challenges facing UK retailers?

Currently worth almost £730 billion (6.5 trillion yuan), according to the Ministry of Commerce, China’s cross-border e-commerce industry is expected to grow by over 30 percent annually over the next few years. This makes it both an attractive proposition for UK online retailers and an important way to develop foreign trade between the two countries. However, many still feel daunted by the apparent challenges that come with selling to China via e-commerce, particularly the various government regulations, which impact shipping and delivery.

It is fair to say that the Chinese cross-border e-commerce industry is unique in terms of the amount of centralisation and government involvement. To understand why there seems to be a never-ending stream of new policies and regulations it’s important to remember that this is a comparatively new way of trading and both the government and the industry are still finding their feet.

Here’s a brief reminder of how far we’ve come, and how quickly. Remarkably, as recently as 2013 there were only two online retailers offering direct shipping to Chinese consumers. Over the next couple of years, the market exploded, and hundreds of new players appeared, including Sainsbury’s and Marks & Spencer. Alongside these well-respected brands, many rogue traders emerged (either selling counterfeit goods or over-extending themselves), keen to take advantage of a new regulation in 2014 that permitted cross-border e-commerce for the first time. As a result, the industry started spiraling out of control and in 2016 the Chinese government introduced a series of new tax policies and regulations aimed at making B2C e-commerce and traditional B2B2C bulk trade a more level playing field. It had an immediate impact, with the total volume of cross-border e-commerce transactions dropping by almost half in 2016.

From confrontation to adaptation

Since the start of 2017, there have been further tweaks to customs policies as the Chinese government continues to get to grips with cross-border e-commerce. Happily, these are making it easier than ever for UK online retailers to trade in China.

The introduction of the infamous “Positive Lists” that were first announced in April 2016, and which will allow only certain products to be imported via China’s free trade zones, have recently been further postponed and it is probable that they may never come into effect. Anyway, products that are not on the lists will still be able to be sold into China via Universal Postal Union (UPU).

Most consumer products, from food and beverages, to cosmetics and electronic appliances, are included on the lists. However, some have additional requirements. For example, baby formula products (under line No 158 of the first list) must be registered with the China Food and Drug Administration Bureau (CFDA) pursuant to the People’s Republic of China Food Safety Law. If not, they will be excluded from the Positive Lists. Unlicensed nutritional products without approval from the CFDA are not on the Positive Lists.

Meanwhile, in March this year, the Chinese government confirmed that all cross-border e-commerce imports would now be categorised as “personal articles” and not commercial imports in the traditional sense. This seems reasonable, as items purchased via cross-border e-commerce tend to be for personal use.

This latest regulation will ease the entry process for overseas online retailers considerably. It means that the process of obtaining import permits and product registration documents, which are currently required on all e-commerce imports, will become less complex or even unnecessary. Unlike the traditional bulk trade sector, personal cross-border shopping is made up of low volumes and small orders across a wide number of categories. If the Chinese government was to treat e-commerce cross-border imports in the same way as traditional imports, the resulting complex customs procedures would be off-putting to overseas retailers. Further restrictions could even lead to the return of the chaotic “daigou era”, when a personal shopping agent would purchase items abroad on behalf of a customer in mainland China, and thereby avoid having to pay any customs duties.

The Chinese government is recognising that traditional regulation methods just don’t work with cross-border import. Instead, it is highly likely that the “Positive Lists” will eventually change to “Negative Lists” (which would include a handful of prohibited goods) to allow entry for more products and a reasonable amount of inspection of quality and credentials.

Shipping options

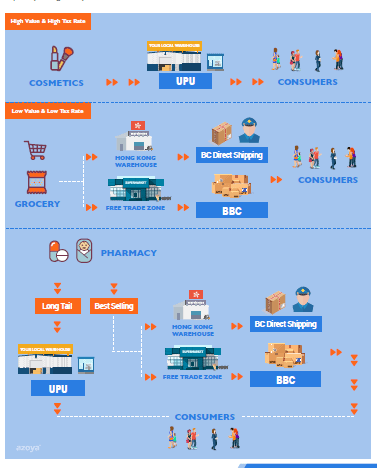

Bearing all this in mind, what are the best ways for a UK online retailer to get their products to Chinese customers’ front doors? The simple answer is that it depends on the category and value of the products, but here’s a useful overview of the main logistics methods for UK retailers, showing which are most appropriate for popular categories.

Key:

- Drop-shipping: warehousing and fulfillment are in UK and single parcels are sent to consumers via Universal Postal Union (UPU).

- Free trade zone: stock in bonded warehouses in Hong Kong or free trade zones in China and ship from there to customer.

- BC: Business to consumer

- BBC: Business to business to consumer

What is apparent is that certain categories, such as cosmetics and healthcare products, have an advantage as they can be sent by a variety of shipping options. Drop-shipping is widely used by many overseas retailers, including Feelunique, the largest online premium beauty retailer in Europe. Coming directly from the source country, it guarantees the authenticity of a product. It also avoids the issue of no longer being able to use bonded warehouses if Feelunique’s products were ever removed off the Positive List.

Looking ahead, a hybrid model could be adopted. For example, goods such as perfumes and bestsellers could be stored in a bonded warehouse in Hong Kong as this saves on costs and means a shorter delivery period – and thus a better customer experience.

Tax implications

One important caveat to be aware of is that each shipping option has different tax implications. Essentially, the higher value the product the higher the tax. Tax rates are fast-changing in China, so it makes sense to work with local partners who can advise.

Challenges

Some categories are more challenging to ship via e-commerce. For example, certain groceries are just not cost-effective if you ship them directly to China as single items, as the shipping costs will be much higher than the value of the product. It makes more sense to ship such groceries in bulk and stock the products in a local warehouse.

Optimistic future for e-commerce

Ultimately, there is no one-size-fits-all shipping solution and retailers need to carefully devise the most suitable logistics model for their needs. Where possible, retailers should also offer multiple shipping options to Chinese customers at reasonable rates. Most shoppers in China expect and prefer to pre-pay customs charges or handling fees when shopping online, so retailers should avoid any potential for nasty surprises by being upfront about these charges and offering pre-payment.

China remains a land of relatively untapped, unlimited opportunities to build a new customer base and UK online retailers should not feel fazed by government regulations. With cross-border e-commerce sales in China already accounting for 20 percent of China’s foreign trade and strong growth predicted, it’s in the interest of all parties that the industry is nurtured and given the necessary support.