There are promising prospects for UK businesses in China’s car service sector, including in the growing spare parts market, writes Tom Pattinson

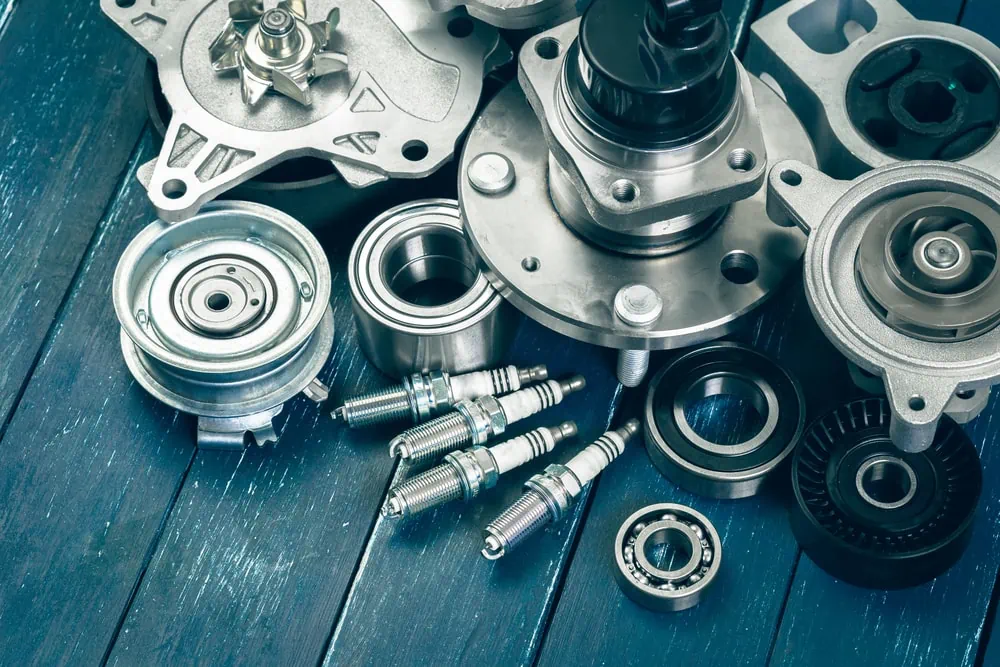

Over the last few decades, the rise of the middle class, rapid urbanisation, and robust economic growth have all contributed to a surge in car ownership in China. As the world’s largest automotive market, China currently represents nearly one-third of all global car sales. Moreover, the country’s domestic car production is continuing to expand, attracting both international and domestic automotive brands and driving the demand for car parts.

“China’s average car age is low; currently at around 5 years old. To give a comparison, in the UK the average is around 10 years old. As the cars in China age, the requirement for spare parts, for general maintenance and repair will also increase, in line with this growth,” says David Gregory, China Market Business Advisor, CBBC.

Although the landscape is promising, significant challenges need to be addressed to fully unlock the potential for growth in China’s car parts market. The most formidable challenge is the extensive fragmentation that characterises the sector. The market is saturated with independent service outlets, ranging from small-scale neighbourhood repair shops to larger, specialised service centres, all catering to a diverse range of customer needs. This fragmentation poses a substantial barrier for international businesses aiming to establish a significant presence in the market.

China’s car service centres are rapidly adopting new technologies to enhance their offerings. Advanced diagnostic tools, electronic vehicle health monitoring systems, and even AI-powered predictive maintenance are becoming increasingly prevalent. These technologies enable service centres to provide more accurate and efficient repairs, thus improving customer satisfaction.

A number of car companies are at the forefront of embracing these technologies in their service centres. Notable international players such as Tesla and BMW are leveraging AI and connectivity to offer remote diagnostics and software updates. Homegrown brands like Nio are also incorporating advanced technologies to enhance customer experience and optimise vehicle performance.

The car repair sector in China is also witnessing a transformation in terms of required skills. As new technologies become integral to the industry, the demand for technicians skilled in diagnosing and repairing advanced electronic systems is growing. Additionally, expertise in handling electric vehicles (EVs) is becoming crucial, given the rapid adoption of EVs in China. This demand for specialised skills presents both a challenge and an opportunity for the industry.

However, certain skills are still lacking within the sector. A shortage of technicians proficient in handling cutting-edge technologies remains a concern. Bridging this skill gap will be crucial for the industry’s sustainable growth – and could present an opportunity for UK skills providers like the Institute of the Motor Industry. “[Certification for technicians and fitters can] contribute to a more skilled and knowledgeable workforce in the parts and service industry and can be seen as an important aspect of welfare for China/UK parts distributors and enterprises,” says Herbert Lonsdale, Global Skills Ambassador for the Institute of the Motor Industry.

There are promising prospects all around for UK businesses in China’s car service sector. “The UK continues to be associated with high-quality manufacturing and engineering expertise. This reputation can give UK parts providers a competitive advantage in the Chinese market, where discerning consumers’ value premium products,” says Lonsdale. “British-made parts can command a premium price and attract customers seeking reliable and well-engineered components. China is also actively investing in research and development, aiming to become a global leader in technological innovation. There are opportunities for UK parts providers to collaborate with Chinese counterparts to leverage their advanced manufacturing technologies and enhance their product offerings”.

As the average age of vehicles on Chinese roads increases, the demand for servicing and repairs is set to soar. This presents a significant growth opportunity for businesses in the servicing sector. Independent service centres that can provide specialised maintenance and repairs tailored to the evolving needs of ageing vehicles are poised for success.

A noteworthy trend in China’s car parts market is the rise of one-stop service centres. These comprehensive service hubs offer a range of solutions, including repairs, maintenance, and access to spare parts – all conveniently located under one roof. This trend aligns with the preferences of modern consumers for integrated services, opening a unique avenue for businesses to position themselves as holistic service providers.

China’s burgeoning second-hand car market presents yet another promising opportunity for the car parts sector. As more consumers opt for used cars, the demand for spare parts to maintain and repair these vehicles is expected to surge. This shift creates an ideal environment for businesses to offer cost-effective and reliable solutions to cater to the growing number of second-hand car owners.

14 September: CBBC Auto Roundtable event in collaboration with the Institute of the Motor Industry

The next CBBC Automotive Roundtable of 2023 will be hosted by the Institute of the Motor Industry at its conference centre on 14 September.

This roundtable will focus on how the industry is tackling new automotive technology and the skills gap, with speakers including Steve Scofield FIMI, Head of Business Development, Institute of the Motor Industry; Owen Edwards, Head of Downstream Automotive Consulting, Grant Thornton; Andy Turbefield, Head of Quality at Halfords Autocentres; and David Gregory, China Market Business Advisor, CBBC.

After the presentations from the Institute of the Motor Industry, Grant Thornton and Halfords, there will be a Q&A session, where you’ll get the chance to put your questions directly to the industry experts. The event will conclude with a networking buffet lunch.