The Chinese music industry has been stagnant for sometime, but its now about to blossom thanks to UK business, writes Daniel Lincoln

Unlike neighbouring South Korea with its lively K-Pop scene, China’s music scene has never really taken off. A smattering of Cantopop stars aside, monetising China’s music industry has proved a challenge. However, following a number of recent deals, it seems a corner may have been turned and the global music industry is looking to China as the world’s next potential zone for growth – and possibly a template for elsewhere.

Popular music in China really only started to gain traction in the late 90s when internet streaming was becoming widely available and people could access music from around the world. Prior to the internet age, music lovers would buy pirated CDs from market stalls. There was no real experience of paid-for music in China as there was elsewhere. “People had no concept of paying for music,” Yu Li, CBBC’s Creative Industries Lead in the UK recalls. “The Chinese have been used to pirating music for decades, and so the idea of paying was very new.” Today, however, that is changing. A number of digital platforms are now offering free music streaming, meaning that illegal downloads are losing their lustre.

The challenge for the industry is to further persuade users to pay for what they didn’t need to before. But with younger middle-class Chinese consumers enjoying rising levels of disposable income, they are now more willing to fork out for music they like. The key for platforms is to provide a service worth paying for.

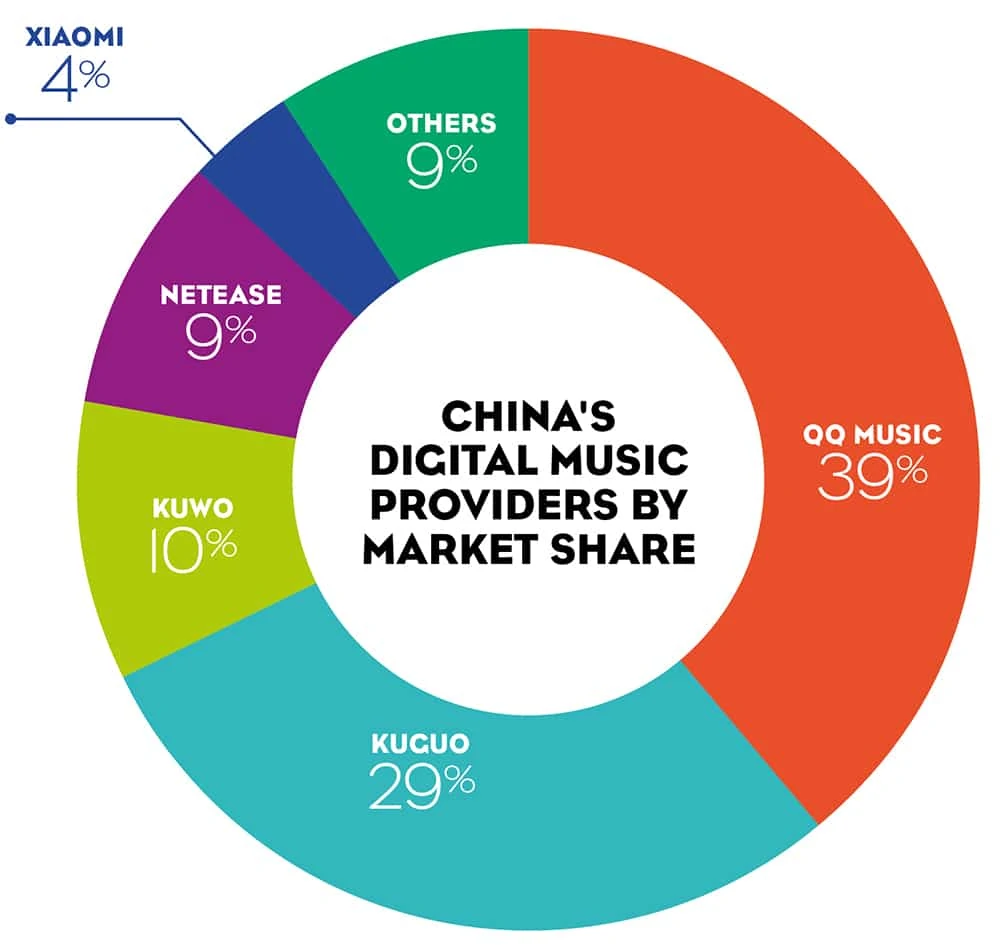

Tencent Music Entertainment Group’s (TME) platforms, is China’s biggest provider of music streaming services. TME owns the top three streaming platforms in China: QQ Music, Kuguo, and Kuwo, and in 2016 held a 78 percent share of the digital music market. And that market is not small. China’s digital music market was worth RMB 52.9 billion (£6.2 billion) in 2016, a growth of 6.2 percent over 2015. And as the world’s 10th largest market for recorded music it still has plenty of scope for growth.

“China has a conversion rate of just three percent, far below the 20-30 percent seen in many other countries”

China’s musical landscape is almost entirely digital. Compared with South Korea and Japan whose digital market makes up 59 percent and 20 percent respectively, China’s digital market makes up a whopping 96 percent of recorded music revenue. It is therefore no surprise that Chinese music lovers prefer to stream digital music via their mobile phones.

Interestingly, 80 percent of Tencent’s listeners are streaming just four percent of their tracks – these are the small percentage of Chinese language songs. This doesn’t mean international artists can’t get in on the act though: healthy growth and the popularity of streaming mean there’s plenty of space for the UK’s music talent to thrive in China.

QQ Music, China’s most popular music platform, offers free and paid subscriptions, not dissimilar to Spotify. Paid subscriptions cost up to RMB 12 (£1.41) a month and unlocking higher quality playback, complete access to the platform’s library, and the option to download songs for offline listening.

TME has over 700 million monthly active users (MAUs), with more than 15 million of them paying a subscription fee. By comparison, Spotify had 157 million MAUs at the end of 2017, 71 million of which are paid up subscribers. It is here that the opportunities and challenges for participants in China’s music industry lie. Chinese streaming platforms have large numbers of users but a low proportion of paid subscribers. TME’s figure of 15 million is a conversion rate of just three percent, far below the 20-30 percent seen in many other countries.

It is still the case that in China, exclusivity deals between licensing companies and platforms are the norm, meaning a licensing company’s catalogue is only available on one platform unless that platform grants access to its competitors. This is changing though. Global digital rights agency Merlin signed non-exclusive deals with Tencent, NetEase, and Xiami (Alibaba) in March 2018 and Outdustry, a leading Chinese music industry consultancy firm, were instrumental in the coordination of this deal. Alex Taggart, General Manager of Outdustry in Beijing says Merlin has gone against the trend of exclusivity by “setting a new narrative in the Chinese streaming market and dispelling the notion that an exclusive deal with a single partner is the only way for overseas rights holders to access China.”

This deal has enabled Merlin’s catalogue, drawn from more than 20,000 independent labels and distributors, to reach the Chinese market, significantly expanding the range of music legally available and the appeal of the streaming services involved. Taggart notes that this is a win-win deal, as “Merlin’s content will be behind a paywall in China, restricting caching and high-quality playback to subscribers, a move that aims to increase the value of a subscription and grow the overall value of the streaming business, both for streaming services and Merlin members”. This deal is a big step forward for music licensing in China, and lays out a path that others may soon follow.

To connect British businesses with music industry experts in China, CBBC recently helped the British Phonographic Industry and the UK’s Department for International Trade organise its second Music Mission to China. The Mission took place on 9th-15th April 2018; over 20 delegates flew out to Beijing for meetings and briefings on the Chinese music industry, and to hear talks from industry experts, including Outdustry, on topics from intellectual property to the live music scene. Present at the Mission was Chris Tams, Director of Independent Member Services and International at the British Phonographic Industry, who spoke of the event’s importance.

“With a burgeoning aspirational population that clearly has a love of all things British, improving respect for copyright and authentic quality products, and the UK in need of new international trading relationships, the timing of this second visit couldn’t be better,” said Tams. “Music has become Britain’s global calling card and we fully intend to use it in this exciting emerging market which has the potential to transform global music sales”.

While the Chinese music industry might seem like a difficult market to crack, those on the Music Mission discovered that the building blocks are in place for a bright future. Digital platforms are proving that they are receptive to western music, and can provide opportunities to get UK music into the hands (or, indeed, ears) of Chinese consumers. It seems the sleeping giant is finally starting to awake.