Sandra Weiss from Redfern Digital explores how Chinese social media platform Xiaohongshu has evolved this year, and how brands can exploit the platform’s features to increase purchase and conversion rates going into 2023

Xiaohongshu (also known as Little Red Book or RED) is a thriving place for Chinese users to share product and brand experiences, provide and obtain recommendations and lifestyle tips, and most importantly, discover new products and brands. As one of the most popular platforms in China, Xiaohongshu currently has over 150 million monthly active users, which represents a 50% growth in traffic compared to January 2020.

The platform is known for its user-generated content, which feels trustworthy and authentic to viewers and can be utilised for word-of-mouth marketing. This feature is further enhanced by the algorithmic feed that shows users a combination of content from accounts they follow, trending content, content based on user interests and location-based content, making the platform perfect for product discovery. Moreover, due to this algorithm, posts on Xiaohongshu, called notes, tend to have a much longer lifespan compared to platforms such as WeChat. Notes will still generate new traffic a month after being published, although the cycle of when and how content boosts occur is hard to predict. On the other hand, the lifespan of content on WeChat usually lasts less than seven days, as it is only pushed to WeChat account followers, making it difficult to obtain organic traffic.

With that said, these are some of the top trends, insights, and strategy suggestions for Xiaohongshu for 2022.

Shift in user demographic

Although the platform demographic remains largely female, the percentage of male users has risen from under 10% a few years ago to almost 30% today. Despite the influx of male users, Xiaohongshu users remain young, with almost 75% under the age of 35 years old. Moreover, users on the platform tend to have higher purchasing power and over 50% come from Tier 1 and Tier 2 cities, including Shanghai, Beijing and Guangzhou.

These demographic shifts present new opportunities for brands and categories, with more male-dominated content having a chance to become popular on the platform and reach the relevant audience.

Top categories on Xiaohongshu

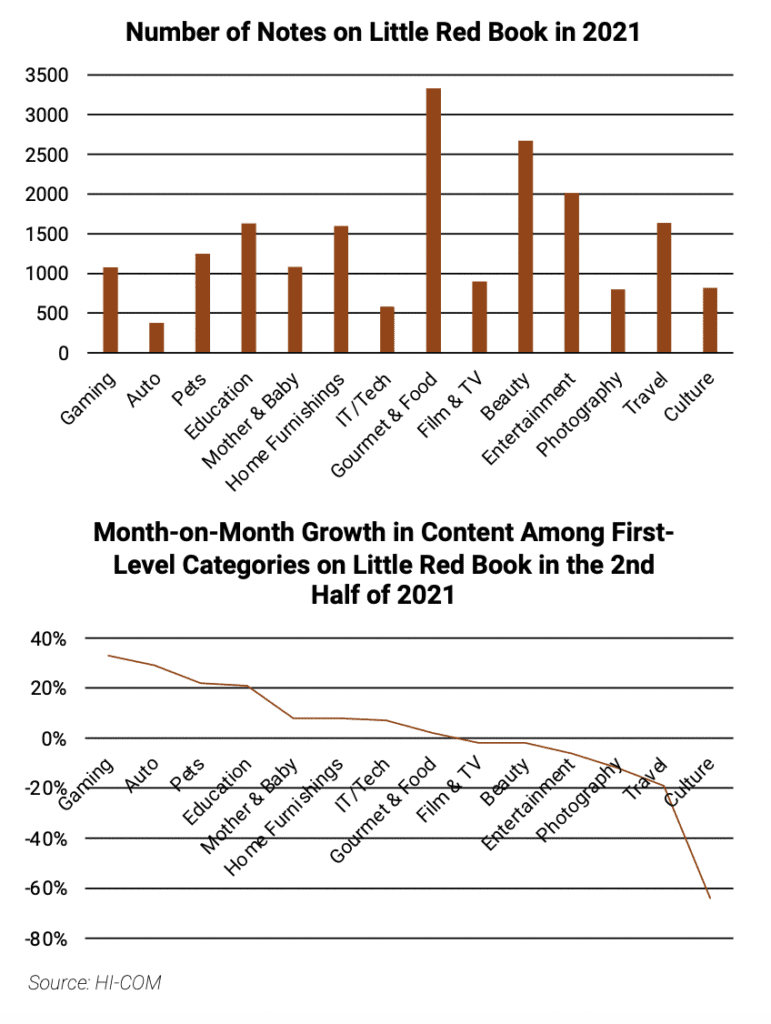

As seen in the graphs above, by the end of 2021, the top categories when it came to notes posted on Xiaohongshu included gourmet and food, beauty, entertainment, travel, home furnishings, and education. More typically male-dominated categories such as gaming and auto are showing rapid growth.

A more recent trend from 2022 is the rise of fitness and exercise content, which became popular after the 2022 Beijing Winter Olympics and the lockdowns in China. As a result, more Chinese consumers have become interested in maintaining their health at home, which has caused a surge in notes on Xiaohongshu related to athleisure clothing, home workout equipment, exercise suggestions, etc.

Notes related to beauty remain very popular on the platform, even as the category’s growth rate drops. Top keywords within this category include efficient skincare, effective skincare, gender-neutral products, functional skincare and make-up, and men’s beauty.

How to increase purchase desire and conversion rates

Consumer behaviour on Xiaohongshu indicates that after product discovery, users will leave the platform to make their purchases on other platforms such as Tmall and JD. As a result, the market share of Xiaohongshu in-app stores is declining. However, word of mouth marketing on Xiaohongshu has still proven to be effective at driving sales for brands through their other online sales channels, generating a positive return on investments and continued improvements in store performance.

Dealing with the increased demand for authenticity

Content on Xiaohongshu should include ‘lifestyle’ photos or videos that appear more natural, less commercial and include people who look Chinese. The content should emphasise the people, the products and the environment to build a sense of authenticity. Working with KOLs and KOCs on the platform is a key strategy for increasing brand awareness and reputation, even though the costs of collaborations are rising and KOLs are becoming more saturated on the platform. Reusing content from KOLs and KOCs after permission has been obtained is also highly suggested.

Testing for success

Xiaohongshu has no daily posting limit, which means that there is a lot of space for testing and optimising. Brands can test different types of posts, including professional photoshoots, more natural at-home photos, product-only pictures and graphic illustrations to determine which types of posts perform better. These same tests can be done for different keywords, although brands should also use trending or top-ranked keywords within the relevant categories where possible. Through the results obtained, brands can continually optimise their content.

As can be seen, despite shifts in user demographics and top categories on Xiaohongshu, it remains a crucial platform for brands to utilise when marketing and expanding their presence in China. When developing a strategy for Xiaohongshu, brands need to keep in mind who their target audience is, how to meet their demands and how to attract their attention on a highly competitive and increasingly saturated platform.