As China’s economic growth slows, stable monetary and fiscal policy remain the top priorities for 2022. Beijing is also expected to focus more on housing, pronatalist incentives and ‘tertiary distribution’ under its new Common Prosperity policy

From 8-10 December, Chinese leaders convened their annual Central Economic Work Conference (CEWC). The read-out of the conference stresses the urgent need to address ‘three pressures’: shrinking demand, supply shocks, and a weakening economic outlook.

The Chinese government’s answers to these issues are not really surprising. Stable macro-economic policy – i.e. prudent monetary and conservative fiscal policy – remains the paramount guiding principle for 2022. At the micro-level, supply-side reform and tax incentives are still the government’s weapon of choice. Other familiar policies, such as reform and opening-up, scientific and technological development, the fight against regional inequalities and the maintenance of stable employment and social service provision are all listed among the seven major priorities.

Some new targets involve pronatalist measures to increase the population and the promotion of social housing. Other important goals, such as the prevention of financial risk and China’s much-discussed peak coal and net zero targets, are mentioned but not prioritised. Xi Jinping’s new Common Prosperity policy is described as a long-term challenge with the promotion of the so-called ‘tertiary redistribution’ as the only near-term goal.

Overall, this CEWC indicates that Chinese policies in 2022 might look very much like those in 2021, as Chinese leaders grapple with the challenges of a more affluent, more educated but increasingly older population.

Background

The Chinese economy ended 2021 on a rather sombre note. After 2020’s pandemic-defying 2.3% growth – the only increase of any major economy – last year witnessed several hiccups, with more storms already gathering. Although the country will probably surpass its self-set goal of 6% GDP growth, the Chinese government is facing mounting headwinds.

First, surging factory production outpaced energy production, leading to power cuts and shutdowns. At its height, 20 out of China’s 31 mainland provinces had to impose power rationing. Even though the problem was mostly transitory, rising energy prices and input costs left a chilling effect on businesses. In September, China’s industrial production grew only 3.1%, the lowest increase since the beginning of the pandemic.

Second, the slowdown isn’t just confined to the manufacturing sector. Retail, too, slowed down markedly in the second half of 2021, with November recording its lowest growth (3.9%) outside of the pandemic. Although consumer price inflation, which also picked up last month, might explain some of the lower spending, it’s probably China’s strict zero-Covid policy that remains the main reason for lower sales. During Golden Week in October – a bellwether for Chinese consumer sentiment – tourism revenue dropped 4.7% year-on-year and was at less than 60% of the 2019 level.

Although consumer price inflation, which also picked up last month, might explain some of the lower spending, it’s probably China’s strict zero-Covid policy that remains the main reason for lower sales.

Finally, China’s vast real estate sector — accounting for about 29% of China’s GDP — has come under visible pressure. Several property developers, including the highly indebted Evergrande, failed to make bond payments and entered technical defaults. More worryingly, house prices have begun to drop in many Chinese cities. In November 2021, average prices for new residential properties dropped 0.33% month-on-month, the third straight month experiencing a decline.

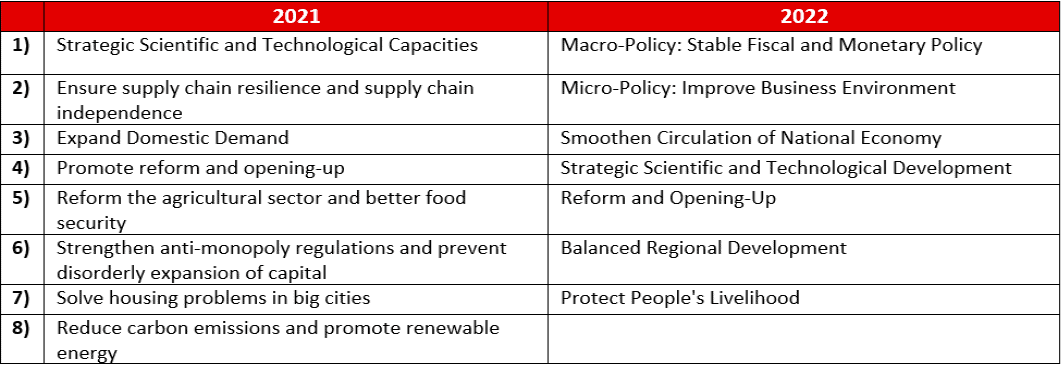

Comparison of CEWC priorities in 2021 and 2022

Stability trumps everything

Confronted with these challenges, this year’s CEWC focused on basic economics rather than long-term strategies. For example, last year’s top priority – scientific and strategic development – is now only the fourth most important item on 2022’s priority list. Other long-term issues, like the reform of China’s agricultural sector and the reduction of carbon emissions, are mentioned as secondary goals but are not referred to as primary concerns anymore. Instead, stable macroeconomic policies and supply-side oriented microeconomic reforms are at the top of the government’s agenda.

Even though most of the items on the 2022 list are hardly new, there are three policy areas that merit closer attention in the coming year.

- Housing: Now subsumed under the general objective of a smooth circulation of the national economy, affordable urban housing will remain a primary concern in the coming year. The CEWC mentions two sub-goals for this issue: 1) the development of a rental housing market; and 2) construction of affordable housing. Recent policy proposals have mainly focused on price controls but more long-term strategies – such as rent-to-buy schemes or a Singapore-style public housing programme – are needed. 2022 will probably see new reform proposals in this direction.

- Pronatalism: The sudden ban on online tutoring and the abolition of China’s birth control policy have underscored how serious Beijing is about reversing China’s demographic decline. It also indicates that the latest census numbers, published earlier this year, might not show the whole story. But increasing birth rates is tricky especially as Chinese women have become more confident and vocal about gender discrimination in the workplace and beyond. Expect more action – whether effective or not – in the coming year.

- Common Prosperity: Common Prosperity has been one of the buzzwords of 2021. But its exact meaning remains contested. So far, pressure on private businesses to share more of their wealth and stiff penalties for tax evaders have been the most visible expression of this new policy. The CEWR points to a similar direction by stressing the importance of so-called tertiary distribution. China’s traditional workfare approach (i.e., job creation rather than welfare), combined with more investment in education, remains the dominant approach for now. However, the planned national basic endowment might offer some new clues about a more comprehensive reform in the future.

As for foreign trade and investment, the CEWR reinforces Beijing’s commitment to openness and support for foreign investment. This is undoubtedly good news. But whether this will be enough to reassure foreign businesses and investors having to deal with China’s increasingly complex domestic regulatory framework and ad-hoc policymaking, is something we can only hope for.

The CBBC view

The key message from this year’s CEWR is that China is in the midst of transition. Beijing recognises that the economy is facing daunting challenges that require new ideas and policy approaches. But Chinese leaders have yet to reach a consensus on how these should look, and – in their absence – resort to the traditional playbook of stable macroeconomic policy and supply-side oriented tools. Tellingly, last year’s hint at ‘demand side’ reforms has vanished from this year’s conference read-out.

Despite the insistence on stability – especially ahead of next year’s 20th National Party Congress – 2022 will probably be seen as a chance for more regulatory action and policy experimentation. Not all measures will be constructive, and foreign businesses are well advised to expect further disruptions and ad-hoc changes.

Nonetheless, Chinese leaders have proven once again that they are capable of reform. Businesses should pay particular attention to regional pilot projects. This applies particularly to Zhejiang province, which serves as China’s first Common Prosperity pilot zone. Regional development plans, such as the Greater Bay Area, the Yangtze River Delta, the Chengdu-Chongqing region, as well the Jing-Jin-Ji capital region will probably lead the way in policy approaches.

In the coming year, CBBC will continue to keep a close eye on China’s evolving policy landscape and keep Members informed of new regulatory developments at both the national and regional level.