The 10th edition of the annual BrandZ ranking reveals that the top 100 Chinese brands have increased in value by $106.8 billion to reach $996.4 billion, a rise of 12% – and in some cases are succeeding because of (not in spite of) Covid-19

“During the 10 years since we first valued China’s brands, the brand landscape has radically transformed as the economy rebalanced from production to consumption, while Chinese consumers have become the most sophisticated on the planet,” explains David Roth, CEO of The Store WPP, EMEA and Asia Chairman and Chairman of BrandZ.”

“Only five brands that were in the Top 10 when the rankings started still remain there today. This year, within just a few months, we’ve seen Covid-19 have a massive impact on the way consumers shop, what they buy, and their relationship with brands. Through all of these changes, the successful brands are those that have embraced digital, and kept pace with consumer preferences and the way they navigate their lives,” Roth says.

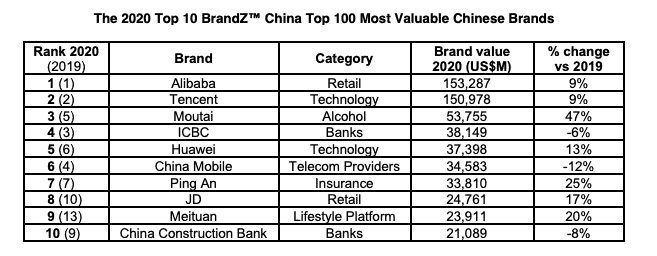

Alibaba remains China’s most valuable brand for the second year in a row, growing 9% to $153.3 billion, while Tencent – number two – rose over 9% to $151 billion. Premium alcohol brand Moutai (+47%; $53.8 billion) has climbed two places to number 3. Alibaba reinforced its leading position with a strategy that focused on lower tier and overseas markets, acquiring NetEase Kaola to meet demand for cross-border retail, and expanding its Freshippo retail and distribution locations. It also linked consumer data and logistics capabilities more closely to better recognise and fulfil customers’ needs.

Fourteen of the 24 categories grew in value, with technology contributing a quarter of the ranking’s total value, and retail around a fifth. Entertainment saw the highest growth for the second year running, rising 221% in value as people spent more time online in lockdown, while education grew by 92% as the increasing popularity of online learning was further stimulated by Covid-19.

Each of the Top 10 Risers (the brands which increased most in value year-on-year) grew by over 50%, with education provider Xueersi (no.38, +120% $4.6 billion) and alcohol brand Wu Liang Ye (no.26, +116%, $8.0 billion) more than doubling in value. Three are education brands, with Xueersi now joined by New Oriental (no.36; +78%, $4.9 billion) and VIPKID (no.84; +67%, $1.3 billion).

Third highest riser Lufax (no.19; +80%, $12.4 billion) – a newcomer to the ranking in 2019 that was created by financial services giant Ping An – grew +80% after successfully broadening its consumer finance operations.

Growth within the China Top 100 has been driven by the ability of the most valuable brands to align with the major trends shaping the Chinese market, including the desire for self-improvement and wellness, rapid urbanisation, premiumisation, and heightened national pride. Many trends were accelerated by Covid-19 as consumers reconsidered their priorities, with the accumulation of wealth declining in importance, and an increased focus on health, the environment, and the welfare of the nation.

Many trends were accelerated by COVID-19 as consumers reconsidered their priorities, with the accumulation of wealth declining in importance, and an increased focus on health, the environment, and the welfare of the nation.

“It has never been more critical for brands to respond to shifting consumer priorities. For example, alongside delivering superior products and services, they need to demonstrate that they care for their employees and customers, the environment and society as a whole,” says Doreen Wang, CEO, Kantar China and Global Head of BrandZ.

“Covid-19 will continue to influence consumer values, attitudes and behaviours, and this will in turn impact needs, desires, brand selection and purchasing. Understanding Chinese consumers today, in all their diversity, depends on having deep, human-centred insights. Brands must then act on those insights, making bold changes where necessary,” she says.

There are 16 newcomers this year, led by short-form video brand Douyin (no.14; $16.9 billion) and e-commerce group buy platform Pinduoduo (no.23; $9.5 billion). Among the new entries are five unicorns (start-up companies valued at over $1 billion): Douyin and video sharing app Kuaishou (no.25; $8.6 billion), real estate agent Ziroom (no.71; $2.1 billion), and tech brands Toutiao (no.67; $2.3 billion) and Zhihu (no.91; $1 billion). Athleisure brand Li-Ning (no.99; $848 million) re-entered the ranking for the first time since 2013, after capitalising on the rise in patriotism with a range that celebrated Chinese culture and design.

Compared with brands in other markets, the BrandZ China Top 100 score highly in two key measures of brand equity, which drives value growth: Power, the consumer disposition to choose a brand over the competition, and Premium, the disposition to pay a higher price. However, Chinese brands lag global brands in another key component, Difference, which means they have an opportunity to drive further value growth by strengthening the perception that they stand out from the competition.

China’s most valuable brands score higher than the average on BrandZ measures of purpose, which has escalated in importance during the pandemic. Tencent shifted from emphasising connectivity to advancing ‘Value for users, tech for good’, while Alibaba focused on helping small businesses to flourish. Pinduoduo enabled local businesses and farmers to sell their products and services in upper tier markets, and Kuaishou supplied e-commerce capability and tools to help low income Chinese develop as online entrepreneurs.

Value growth for the brands that score highly on the BrandZ Innovation Index is almost nine times greater than those that score lower. Haier (no.12; $18.7 billion) has successfully transformed into a leading Internet of Things (IoT) ecosystem brand, the advantages of which include the delivery of a seamless experience, an ecosystem that is boundless, and the ability to offer auto-sensing payments. Owing to continuous collaborative innovation among Haier, its users and its partners, the brand achieves constant improvement and evolution.

The rapid development of smaller cities has created new opportunities. Kuaishou has become a lower tier version of Douyin, while online classified ad marketplace 58.com (no.75; $1.7 billion) launched 58 Town to serve lower tier communities. Pinduoduo, which began by serving lower tier consumers, has achieved national prominence as a rival to Alibaba and JD.

Experience is a critical differentiator; now consumers can get what they want whenever they want it. The brands that score highest on ‘positive experience’ grew the brand value over three times faster year-on-year. Examples include JD, which opened its largest physical store yet, and JD E-Space, an experiential centre where consumers can test and purchase products.

Content commerce is an example of the trend towards experiences that increase convenience by being multifunctional or overlapping. Brands are integrating social media and e-commerce in a way that simplifies people’s lives – creating appealing content that can be seamlessly monetised. For instance, short-video sharing apps like Douyin often provide opportunities to purchase items for rapid delivery.

The BrandZ Top 100 Most Valuable Chinese Brands report and ranking are available to download or via Brandz.com

On 25th November David Roth, CEO of The Store WPP, EMEA and Asia and Chairman of BrandZ will be discussing the report. Sign up here.