After several twists and turns over the last two years, the US and China have called a truce in their trade war; President Trump and Chinese Vice-Premier Liu He signed a Phase One deal on 15th January.

This is far from the end of the conflict – the US still has high tariffs in place on hundreds of billions of dollars’ worth of Chinese imports. Nevertheless, this initial agreement should at least prevent any further escalation in trade tensions between the world’s two largest economies. Moreover, in signing the deal, China has committed to opening its markets up further, and to providing better protection for foreign businesses.

The latter commitment should ensure that China’s central governments and local administrations put effort into streamlining approval processes for foreign businesses, including those from the UK. Meanwhile, the US government’s reluctance to remove tariffs on Chinese goods will continue to work in favour of UK exporters.

Background

The so-called Phase One Deal is 96-pages long and consists of eight chapters, and comes after 13 rounds of bilateral negotiations. Its main aim is to roll back some of the trade sanctions the US and China have imposed on each other since trade tensions started escalating in March 2018.

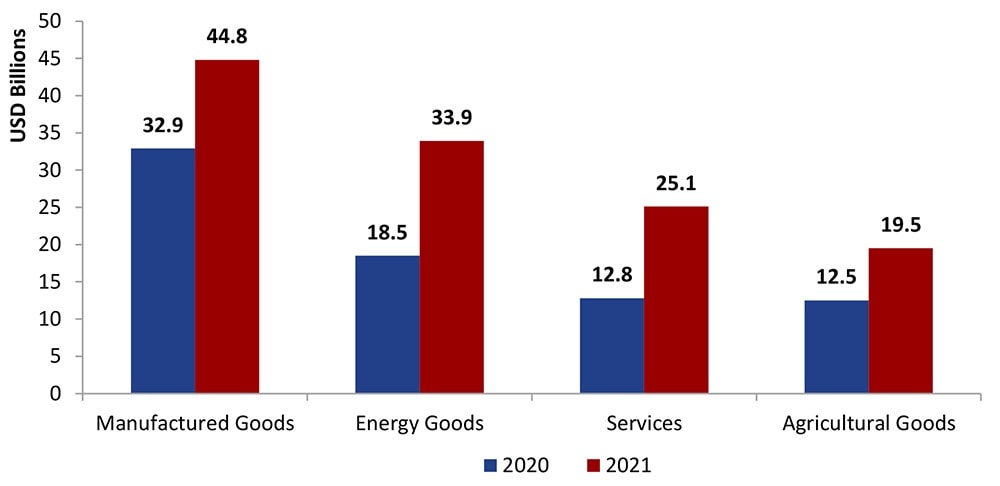

Aside from $32 billion for US agricultural products, China has agreed to purchase an additional $37.9 billion worth of services, $52.4 billion of energy products and $77.7 billion of manufactured goods

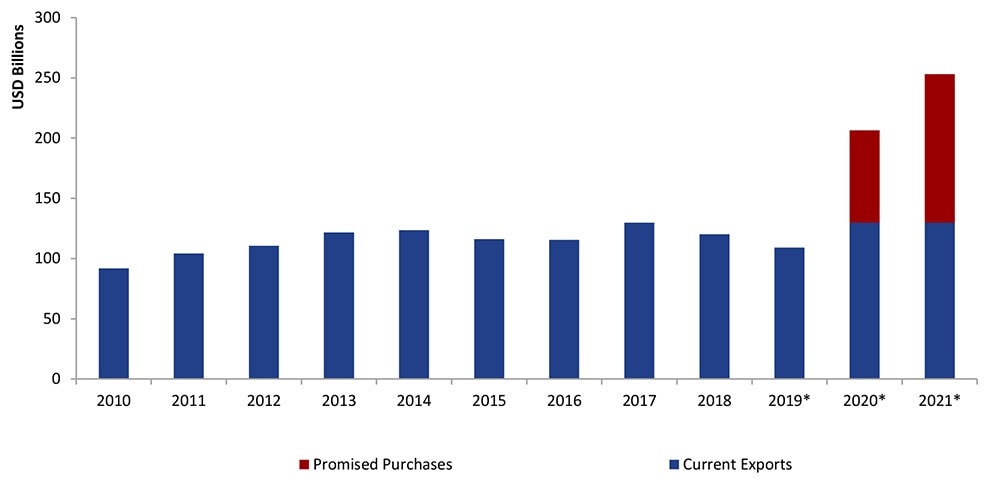

According to the agreement, China has vowed to purchase an extra $200 billion worth of US imports over the next two years compared with a baseline of 2017, when China bought $130 billion worth of US goods.

The fact that US tariffs on Chinese goods largely remain in place, allied to the current strong dollar, should put UK exporters in a strong competitive position

More importantly, the agreement stipulates that China will, within a specified time period, bring its import regulations for farm products in line with World Trade Organisation guidelines and acknowledge US standards for agriculture, aquaculture and dairy products.

Another big Chinese commitment is to strengthen its Intellectual Property Rights (IPR) protection regime. The agreement defines additional violations, which can be classified as trade secret misappropriation, including ‘electronic intrusion’ e.g. hacking – and requires China to incorporate these offences into its own laws and regulations. Moreover, it demands better Chinese enforcement of existing IPR rules, as well as more funding and better training for law enforcement and customs personnel.

Finally, the agreement sets up a Bilateral Evaluation and Dispute Resolution Office. This will become the primary channel for handling bilateral economic affairs, thus replacing the US Treasury as the principal contact point between the two countries. While the exact set-up still needs to be finalized, this could provide a much broader forum for economic coordination and cooperation than the status quo.

Despite these important changes, the existing punitive US tariffs on Chinese imports will largely remain in place. The US administration has already indicated that the higher levies will stay in place until the Phase Two negotiations2, which could be postponed until after the presidential elections in November.

Reactions

Reactions to the agreement have been mixed on both sides of the Pacific. While both governments welcomed the agreement, analysts remain cautious about the long-term impact.

US stock markets reacted positively to the outcome. The three indices – the S&P 500, the Dow Jones and the NASDAQ – all rose sharply on January 15th, setting an intraday record for the sixth consecutive trading session. American producers, too, are optimistic. As CNBC’s Thomas Frank pointed out, the targeted purchases would more than double the current amount of US products sold to China annually.

Plenty of analysts have questioned whether such an increase is feasible though. Liu He himself indicated that any purchase decisions by China would be based on market conditions5, an important caveat.

Chinese reactions were no less ambiguous. While the official press lauded the Phase One Deal as a ‘strong trade agreement’ that is beneficial for both countries and the world, other Chinese observers are more sanguine. For example, the WeChat account Taoran Notes – believed to be close to Liu He’s trade delegation7– described the agreement as the lowest common denominator, leaving everyone dissatisfied while offering both sides some temporary wins.

What does the Phase One Deal mean for UK Businesses?

Although the Phase One Deal is primarily a bilateral agreement, it will also have repercussions for UK businesses.

For a start, China’s commitments to improve its IPR regime and to lift restrictions on agricultural products will benefit all foreign businesses in China and improve the operating environment there.

China’s promise to open up its financial markets to US companies is largely in line with its general reforms in this sector. But importantly, the agreement provides a black-and-white roadmap for this to happen, which should put additional pressure on local authorities to speed up their implementation. As CBBC member and leading Chinese law firm LLinks wrote in a client note, the agreement adds a clear timeline to previous announcements, and so makes it more likely that the necessary guidelines for market opening will be released soon.

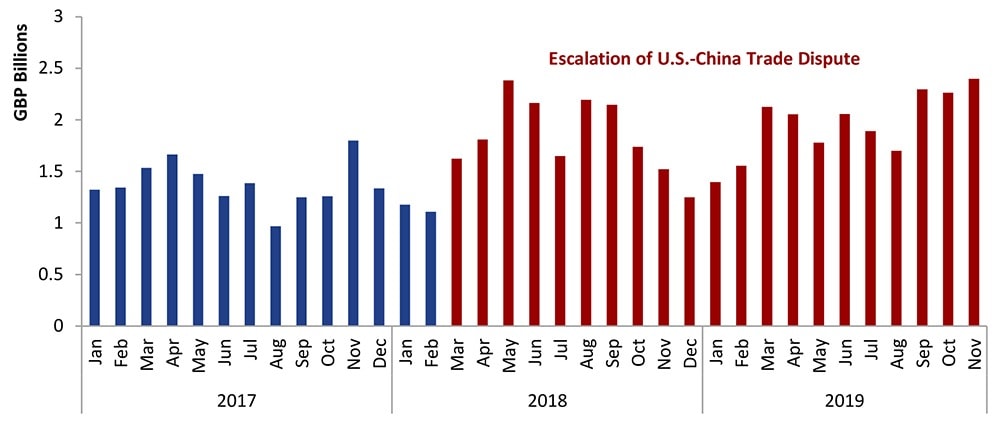

Monthly Exports from the UK to China (in GBP billion)

UK trade with China should also continue to grow in the wake of the agreement. Throughout the trade dispute, UK exports have shown a steady upwards trend, reaching a record-breaking £21.5 billion for the first eleven months of 2019. (Graph 3)

The promised Chinese purchase order of US goods is unlikely to alter this trend. China’s reassurances to other trading partners aside, the fact that US tariffs on Chinese goods largely remain in place, allied to the current strong dollar, should put UK exporters in a strong competitive position.

Finally, the agreement makes a further escalation of the trade war less likely, thus providing a stable short- and medium-term outlook for global businesses. Shen Yi, a professor at Fudan University, is right to emphasise that the agreement’s biggest achievement is its positive impact on the general economic outlook for 2020. In a year already marked by potential uncertainty from Brexit and a US presidential election, this means that company managers will have one problem less to worry about.

For more information about China policy contact Torsten Weller