China often leads the world when it comes to establishing marketing trends. The annual Totem Marketing Report provides a hugely insightful and detailed overview of what trends we can expect to witness over the coming year. We’ve picked out five that we expect will impact the way brands market in China.

1. Key Opinion Leaders will give way to Key Opinion Consumers

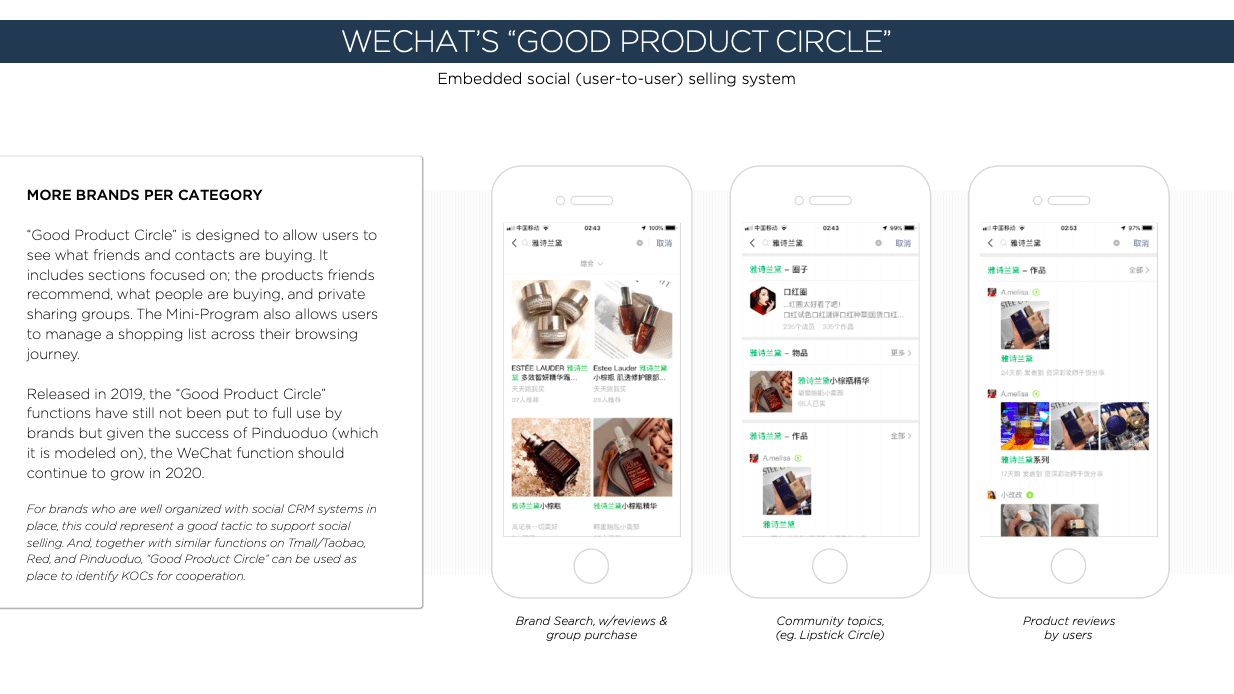

Key Opinion Consumers create a better product circle

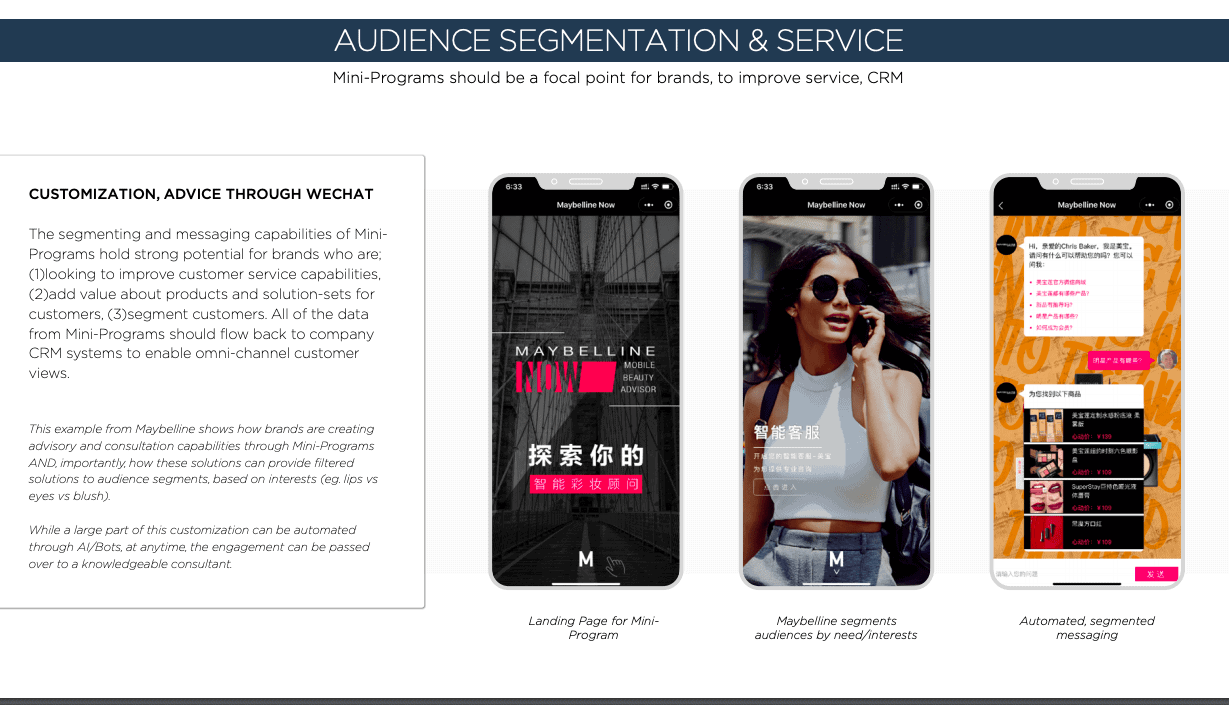

KOCs (Key Opinion Consumers) are individuals that brands have conscripted to sell and advocate on behalf of products. They help to ‘seed’ products into communities and groups they are part of – namely on WeChat – and then encourage group purchases. The goal in working with KOCs is to identify people within these groups who are already (authentically) talking about the brands products – and then, look to incentivise and support them further – to more vigorously advocate for the brand. By selecting individuals who are already advocates for the brand within small communities, the additional aim, is to have them stimulate user-get-user sales.

2. The answer to WeChat fatigue: Interest-based communities

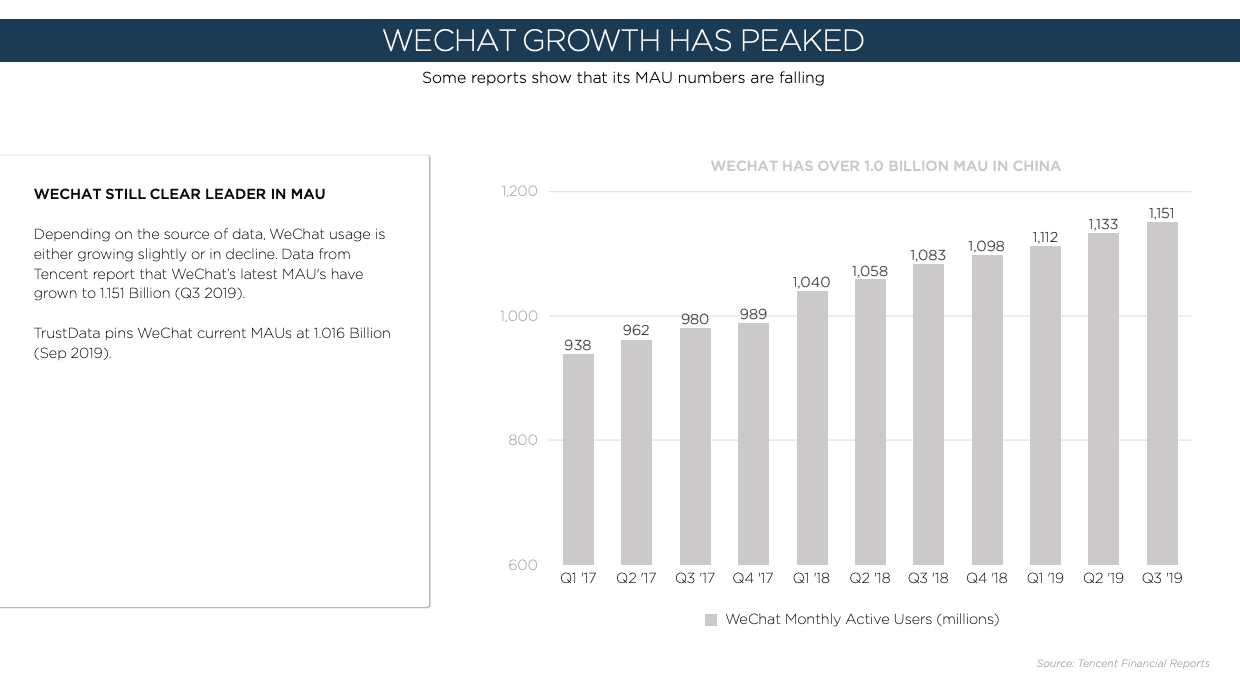

Has WeChat’s growth peaked?

While ‘Super Apps’ (WeChat, Alipay and others) dominate and hold the largest share of Monthly Active Users (MAUs), they have become, by many accounts, too crowded, too noisy and too commercial.

Depending on the source of data, WeChat usage is either growing slightly or in decline. It might have peaked its capacity of attraction. For these reasons, there is something of a counter-movement growing, with audiences seeking more austere, clean environments where the focus is more on content and ideas, less on ads and e-commerce.

WeChat might have peaked its capacity of attraction. For these reason, there is something of a counter-movement growing

Several new platforms built around shared interests and community attracted attention in 2019. Tencent and Bytedance jumped (further) into this space in 2019, with Tencent-backed Jike, and Bytedance’s launch of Feiliao. Sina also offered up a new platform called Oasis which was designed to fit into this set of apps trying to (1) satisfy interest-based communities, and (2) create less commercial, more simple interfaces. None of these recent launches has had profound success yet, as perhaps they are not going far enough to satisfy audience needs.

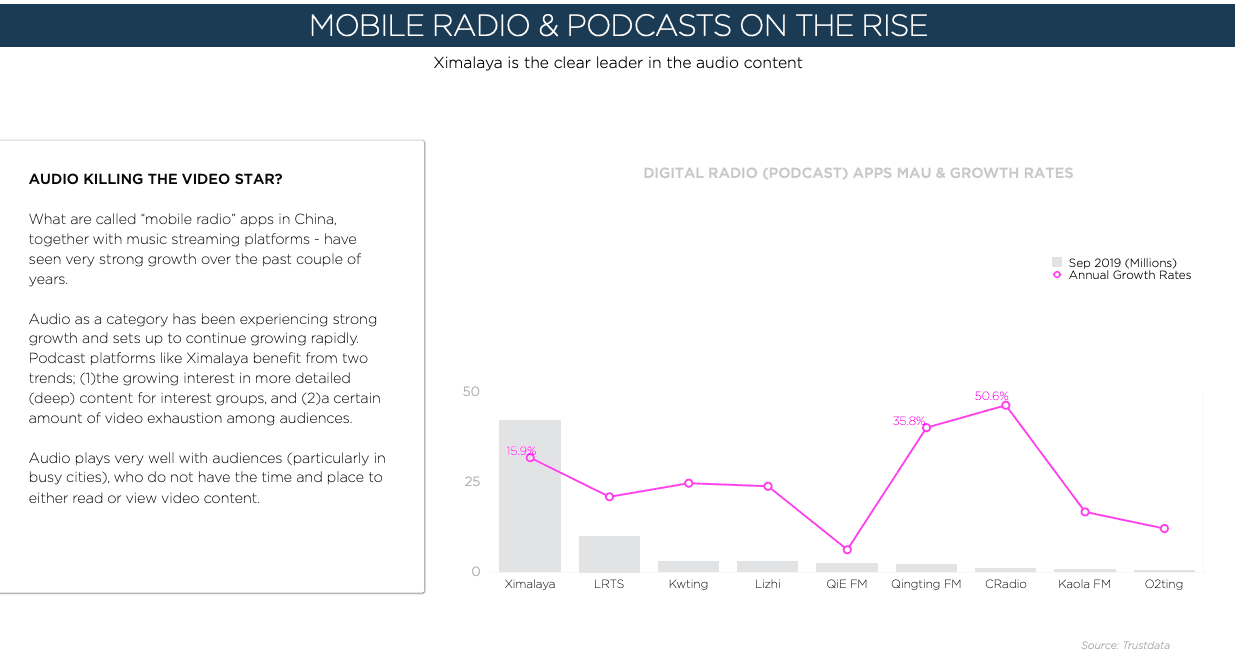

3. Podcasts Turning Up The Volume

Podcasts are on the rise

Audio continues to prove that it has a strong place in the media mix. There are several trends that support an increase in audio-form (podcasts & narratives);

- Audience burnout and overstimulation with video

- The increasing effectiveness of audio-based AI (Alexa or Siri)

- People are constantly on the go and too busy for appointment viewing of video

The Coronavirus might have delayed this shift from video to audio a little, as long commutes and time in the gym have been replaced by time on the sofa.

4. 5G will be the new frontier for long-form videos and AR

Augmented reality will help customisation

Bytedance has been stealing the limelight of long-form videos in recent years. The current completion rate for watching video ads on mobile is very low when compared with desktop, so the speculation is that 5G will improve the viewing experience on mobile – and viewership stats for ads. The feasibility of many Augmented Reality/Virtual Reality concepts will also be improved. So, keep an eye on these functions to make the most of the benefits of 5G:

– Mobile games and game streaming apps

– Traditional video platforms with quality, long-form content, such as iQiyi, Youku, Tencent Video.

– Live-streaming sites

– WeChat and Weibo re-launching existing features such as Vlogs

5. Gaming And e-Sports

In-game advertising in e-sports will grow

Gaming and e-sports should become priority areas for branding in the coming years.

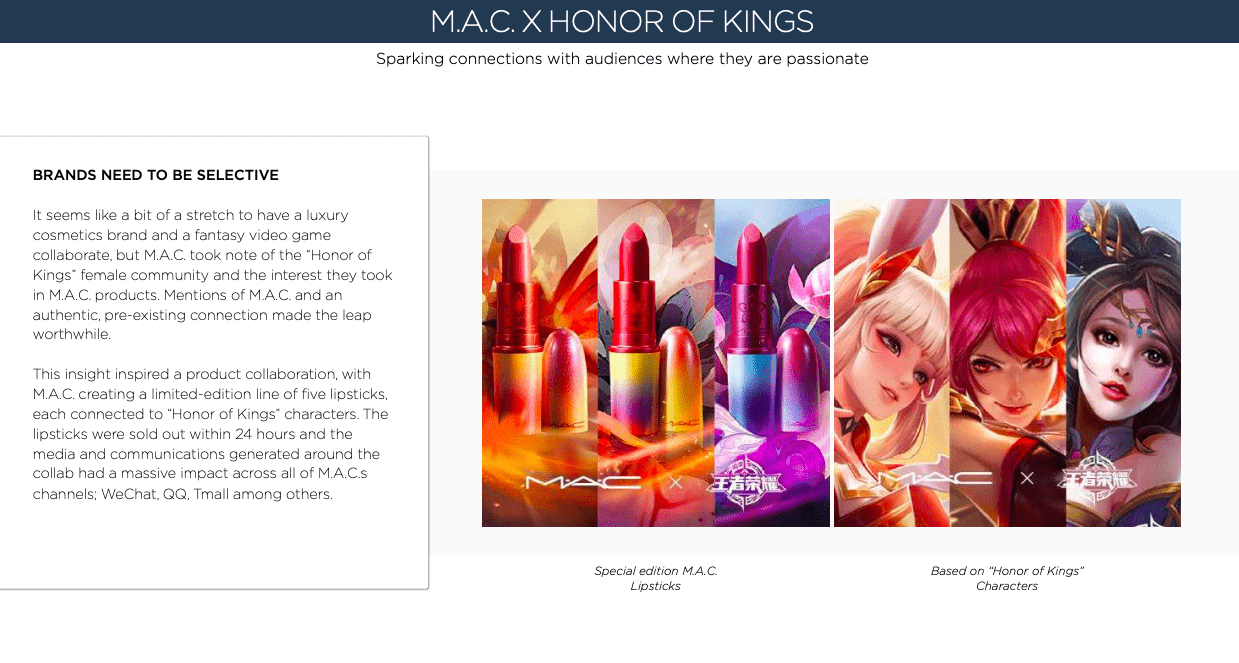

Several brand cross-over promotions have been very successful. Youth audiences in China are shifting their time and attention further toward video games. 2019 saw some notable brand collaborations in this space – including two from luxury brands (LV and MAC).

Instead of trying to make their own video games, brands should be looking into these sorts of collaborations, where they can tap into a hyper-engaged audience of fans and add value to the experience/environment of the game with product placements, virtual goods, e-Sports sponsorships or with co-branded (physical) products (such as MAC did with Tencent’s Honor of Kings game).

If you choose the right partner brand, this boost of awareness should come with the benefit of also gaining access to a new audience.

Download the full report here or contact Chris Baker, Managing Director of Totem Media

For more information on China’s creative sector contact Chris Lethbridge